Engaging your prospective investors from the time they show interest in your opportunity until they invest is essential for a successful funds raise during a capital raising process.

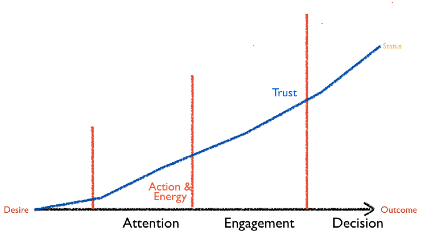

One of the main advantages of using a CRM or Capital Raising Platform is that you can monitor prospective investors progressing along the timeline from “desire” to “outcome”. The outcome they eventually desire is often a return on the funds they invest. For example if they buy shares in your company for say 50 cents a share they hope one day to sell the shares for more than 50 cents, maybe a dollar or two. However at this early stage they just want to be convinced that investing is the right thing to do. As they get to know you and your opportunity or offering their level of trust and belief will rise and they will move to getting ready to make a decision.

The decision to invest funds in your capital raising depends on a number of factors: invest.

- 1) How high on the trust curve the investor has travelled while you are raising funds.

- 2) If sufficient communications have been received to move the investor from taking notice of your offering, to becoming engaged in your information flow to eventually having enough information to invest

- 3) How much momentum your offering has with prospective investors and if people can easily see how popular it is and what funds are raised.

Fund raising momentum brings social proof and credibility. Many investors sit on the sidelines waiting for evidence that others are investing. That means that your capital raising process needs to keep prospective investors informed about how your capital raising is going. If the momentum is energetic and investment funds are flowing they will only know if you tell them. Often there are a couple of hundred people interested so to efficiently communicate updates to them about funds raised to date you need to use the tools available to you on a capital raising platform or your own CRM system.

Leave a Reply